Tax Evasion at the Mercado Modelo Shopping Center in San Ramón

DOI:

https://doi.org/10.56926/unaaaciencia.v2i1.37Keywords:

tax awareness, control function, tax orientation, formalization obligationAbstract

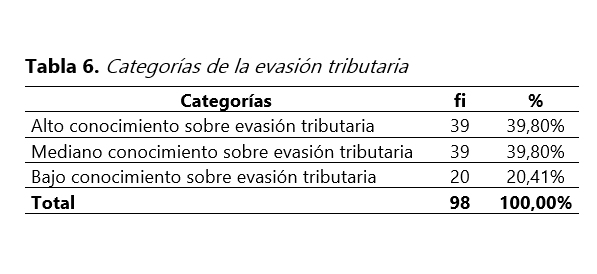

Tax evasion in Peru poses a persistent problem that undermines the fiscal system and limits the resources available for societal development and well-being. The objective of this research was to identify the level of tax evasion knowledge among traders in the Mercado Modelo Shopping Center, San Ramón - 2019. The research was framed as a quantitative approach with an applied purpose. The general method employed was scientific, and specific methods used included descriptive, theoretical, and statistical. The applied design was simple descriptive, where observation and data collection were conducted based on a specific time period, making it a cross-sectional study. The survey was used as a technique, and the questionnaire served as part of the instrument. According to the analysis of results, a moderate level of tax evasion was identified, as evidenced by 39.80% of respondents expressing such opinions, similar to those indicating high evasion. The respondents also demonstrated a moderate level of knowledge regarding taxation and the purpose of revenue collection. However, it was revealed that the information needed by taxpayers is not fully implemented, as indicated by 20.41% of the sample lacking guidance.

Downloads

References

Alva Matteucci, M. (2018). Pautas para entender la teoría de los juegos y la evasión tributaria. Blog de Mario Alva Matteucci. http://blog.pucp.edu.pe/blog/blogdemarioalva/2018/12/14/pautas-para-entender-la-teoria-de-los-juegos-y-la-evasion-tributaria/

Cabrera Sánchez, M., Sánchez-Chero, M., Cachay Sánchez, L., & Rosas-Prado, C. (2021). Cultura tributaria y su relación con la evasión fiscal en Perú. Revista de Ciencias Sociales, 27, 204–218. https://doi.org/10.31876/rcs.v27i.36503 DOI: https://doi.org/10.31876/rcs.v27i.36503

e Hassan, I., Naeem, A., & Gulzar, S. (2021). Voluntary tax compliance behavior of individual taxpayers in Pakistan. Financial Innovation, 7(1), 21. https://doi.org/10.1186/s40854-021-00234-4 DOI: https://doi.org/10.1186/s40854-021-00234-4

Mindiola Perez, G., & Cárdenas Ramirez, E. (2014). Factores que inciden en la evasión del impuesto de industria y comercio por parte de los comerciantes del municipio de Ocaña [Universidad Francisco de Paula Santander]. http://repositorio.ufpso.edu.co/handle/123456789/1196

Núñez Sánchez, A. E. (2015). Determinantes económicos en la recaudación fiscal de las pymes de la provincia de Santa Elena [Universidad de Guayaquil]. http://repositorio.ug.edu.ec/handle/redug/8967

Pérez Maldacena, J. I. (2022). Las empresas Fintech y su influencia en la inclusión financiera en Argentina [Universidad de San Andrés]. http://hdl.handle.net/10908/19225

Quincho Rojas, T. G. (2021). El impacto de la recesión económica ocasionado por la pandemia de covid-19 en la inclusión financiera del Perú. Visionarios En Ciencia y Tecnología, 6(S1), 126–166. https://doi.org/10.47186/visct.v6iS1.79 DOI: https://doi.org/10.47186/visct.v6iS1.79

Suclle Puma, R. (2017). Conciencia tributaria y evasión tributaria en los comerciantes de abarrotes del distrito de Laberinto, Madre de Dios, 2016 [Universidad Andina del Cusco]. https://hdl.handle.net/20.500.12557/1105

Vara Morales, D. (2018). Evasión tributaria del nuevo régimen único simplificado y la recaudación fiscal en los comerciantes del Mercado Modelo de Hánuco, 2018 [Universidad de Huánuco]. http://repositorio.udh.edu.pe/123456789/1266

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Keyla Alessandra Villon-Sedano, Darlynthon Kevin Vilcapoma-Venturo, Richard Zegarra-Estrada

This work is licensed under a Creative Commons Attribution 4.0 International License.

The authors retain their rights:

a. The authors retain their trademark and patent rights, as well as any process or procedure described in the article.

b. The authors retain the right to share, copy, distribute, execute and publicly communicate the article published in the scientific journal UNAAACIENCIA-PERÚ (for example, place it in an institutional repository or publish it in a book), with an acknowledgment of its initial publication in UNAAACIENCIA-PERU.

c. Authors retain the right to make a subsequent publication of their work, to use the article or any part of it (for example: a compilation of their works, notes for conferences, thesis, or for a book), provided that they indicate the source. of publication (authors of the work, magazine, volume, number and date).