Factors of tax evasion in hotel services in the district of Chanchamayo, Peru

DOI:

https://doi.org/10.56926/unaaaciencia.v2i2.41Keywords:

tax administration, taxpayers, economic factors, legal factors, sociological factorsAbstract

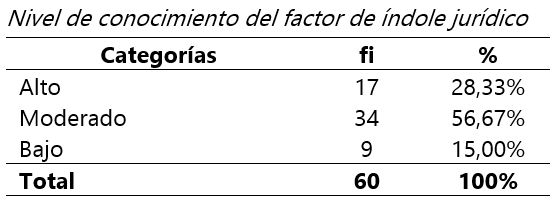

Tax evasion in the hotel sector is an economic challenge that affects both public finances and fair competition in the industry. In this context, this research proposed to describe the level of knowledge about the factors of tax evasion in hotel services in the Chanchamayo district in Peru. The study was basic, descriptive, quantitative cross-sectional; The sample was made up of 60 hotel service entrepreneurs. The instrument that was used was the questionnaire. The results revealed that 66.67% of hotel service entrepreneurs have a moderate level of knowledge of tax evasion. This is confirmed by performing the statistical contrast with a significance level of 0.05, based on the type of chi square test. In conclusion, taxpayers in the hotel services sector have a moderate level of knowledge about the factors that contribute to tax evasion.

Downloads

References

Abidin, Z. (2023). Effectiveness And Strategies Hotel’s Tax Problems In Baubau City. MIMBAR : Jurnal Sosial Dan Pembangunan, 39(1), 99–107. https://doi.org/10.29313/mimbar.v39i1.2097

Andriani, F., Nurmayani, & Deviani, E. (2022). Hotel Tax Imposition on Households Review of the Principles of Tax Collection (The Four Maxims Adam Smith). Advances in Social Science, Education and Humanities Research. https://doi.org/10.2991/assehr.k.220102.078

Arias, L. A. (2009). La tributación directa en América Latina: equidad y desafíos. El caso de Perú. Naciones Unidas, Santiago de Chile. https://repositorio.cepal.org/items/ffccc0c5-2b5d-4b8f-ab07-662645910282

Cahuana Tapia, R. D. (2018). Relación entre conciencia tributaria y la evasión tributaria del impuesto general a las ventas en las empresas hoteleras de tres estrellas de la Región de Puno 2016-2017 [Universidad Nacional del Altiplano]. https://repositorioslatinoamericanos.uchile.cl/handle/2250/3277422

Chidebelu Chike, O., & Chidiebere Michael, E. (2020). Challenges of Tax Auditors and Investigators in Abia State, Nigeria. Journal of Finance and Accounting Research, 2(2), 1–13. https://doi.org/10.32350/jfar/2020/0202/620

Cornejo Espinoza, S. A. (2017). La evasión tributaria y su impacto en la recaudación fiscal en el Perú [Universidad César Vallejo]. https://repositorio.ucv.edu.pe/handle/20.500.12692/14553

Delgado Lobo, M. L. (2009). ¿Por qué una educación fiscal? Documentos - Instituto de Estudios Fiscales.

Flores García, I. E. (2019). Causas de la evasión tributaria en los comerciantes de abarrotes del Mercado Modelo de Huancayo en el año 2016 [Universidad Continental]. https://repositorio.continental.edu.pe/handle/20.500.12394/5137

Fossa Crespo, G. A. (2017). Análisis de la Informalidad y Evasión Tributaria en los hospedajes ubicados en la urbanización Piura, 2017 [Universidad César Vallejo]. https://repositorio.ucv.edu.pe/handle/20.500.12692/10753

Hoxhaj, M., & Erjus, K. (2022). Factors Influencing Tax Evasion of Businesses: The Case of Albania. European Journal of Economics and Business Studies, 8(1), 48. https://doi.org/10.26417/233qcq96

Japura Soria, J. A., & Chipana Ocon, F. (2022). Facturación electrónica en la reducción de la evasión del impuesto general a las ventas en la empresa Hotel Cusco Imperial E.I.R.L. del distrito de Cusco, 2018 [Universidad Andina del Cusco]. https://repositorio.uandina.edu.pe/handle/20.500.12557/4876

Lois, P., Drogalas, G., Karagiorgos, A., & Karasteriou, E. (2020). The phenomenon of tax evasion and undeclared work in Greece. Causes and the role of control mechanisms. International Journal of Managerial and Financial Accounting, 12(1), 71–88. https://doi.org/10.1504/IJMFA.2020.107002

López‐Laborda, J., Vallés‐Giménez, J., & Zarate‐Marco, A. (2023). Fighting vacation rental tax evasion through warnings to potential evaders. Real Estate Economics, 1–30. https://doi.org/10.1111/1540-6229.12425

Paredes Floril, P. R. (2015). La evasión tributaria e incidencia en la recaudación del impuesto a la renta de personas naturales en la provincia del Guayas, período 2009-2012. [Universidad de Guayaquil]. http://repositorio.ug.edu.ec/handle/redug/6881

Parizaca Ventura, W. L. (2023). Cultura tributaria y su relación con la evasión tributaria en las micro y pequeñas empresas del distrito de Ichuña del departamento de Moquegua, 2021 [Universidad César Vallejp]. https://repositorio.ucv.edu.pe/handle/20.500.12692/115286

Payne, J. E., & Saunoris, J. W. (2020). Corruption and Firm Tax Evasion in Transition Economies: Results from Censored Quantile Instrumental Variables Estimation. Atlantic Economic Journal, 48(2), 195–206. https://doi.org/10.1007/s11293-020-09666-2

Quintanilla de la Cruz, E. (2014). La evasión tributaria y su incidencia en la recaudación fiscal en el Perú y Latinoamérica [Universidad de San Martín de Porres]. https://repositorio.usmp.edu.pe/handle/20.500.12727/1106

Rivera Presentacion, J. J. (2022). Evasión tributaria y su relación con la recaudación fiscal en el sector hotelero del distrito de Amarilis, Huánuco, periodo 2020 - 2021 [Universidad de Huánuco]. http://repositorio.udh.edu.pe/handle/123456789/3280

Samhan Salgado, F. (2012). El ilícito tributario: naturaleza jurídica y tratamiento en la legislación peruana. Revista Peruana de Derecho Tributario, 6(17), 1–27.

Shayrani Rosadi, F., Suryani Munawaroh, I., Wicaksono, G., & Nasrulloh Huda, M. (2023). Effectiveness and Contribution of Hotel Tax to Regional Income of Badung Regency. ARBITRASE: Journal of Economics and Accounting, 3(3), 533–538. http://www.djournals.com/arbitrase/article/view/469

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Angelica Jesusa Anaya-Baltazar, Nitzia Emperatriz Lapa-Vargas

This work is licensed under a Creative Commons Attribution 4.0 International License.

The authors retain their rights:

a. The authors retain their trademark and patent rights, as well as any process or procedure described in the article.

b. The authors retain the right to share, copy, distribute, execute and publicly communicate the article published in the scientific journal UNAAACIENCIA-PERÚ (for example, place it in an institutional repository or publish it in a book), with an acknowledgment of its initial publication in UNAAACIENCIA-PERU.

c. Authors retain the right to make a subsequent publication of their work, to use the article or any part of it (for example: a compilation of their works, notes for conferences, thesis, or for a book), provided that they indicate the source. of publication (authors of the work, magazine, volume, number and date).