Financial sustainability through a collection management model

A case study in a savings and loan cooperative

DOI:

https://doi.org/10.56926/unaaaciencia.v3i1.61Keywords:

portfolio, finance, indicators, loans, recoveryAbstract

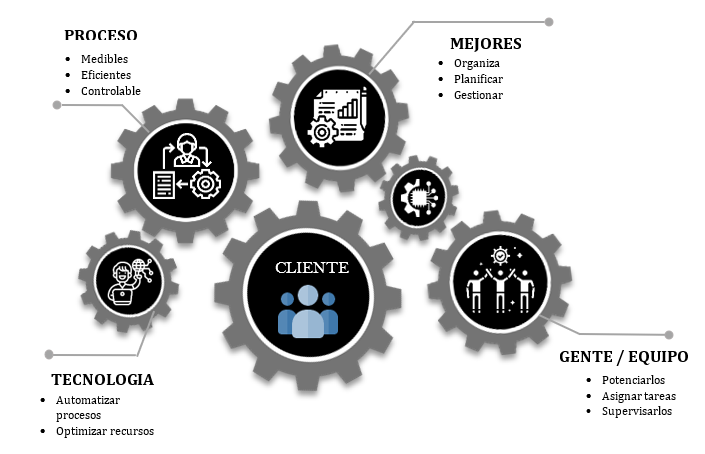

The objective of the research was to design a collection management model to increase the financial sustainability of the Cooperativa de Ahorro y Crédito del Oriente, Tarapoto. A mixed study was conducted, with a first quantitative phase to identify the indicators of financial sustainability and the existing collection management model, and a second qualitative phase for the formulation of the proposed model, carried out over a period of 16 months with a population of 32 business staff involved in the cooperative's collection process. It was found that the staff perceived that the dimensions of the collection management model related to soft skills, cooperativism and information were at a good level, while the dimension of regulations and instruments presented a fair level. A collection management model was proposed that contemplated the implementation of effective collection policies, the strengthening of the payment culture among members, and the improvement of information management. It is expected that the application of the proposed model will enable Cooperativa de Ahorro y Crédito del Oriente Tarapoto to improve its financial sustainability and meet its objectives.

Downloads

References

Aimacaña, M. G., & Pallo, N. S. (2022). Evaluación de la morosidad del microcrédito de la cooperativa de ahorro y crédito Chibuleo ltda., de la ciudad de Latacunga y su impacto en los resultados financieros del año 2021 [Universidad Técnica de Cotopaxi]. http://repositorio.utc.edu.ec/handle/27000/9190

Aquino, P. A., Carrasco, N., Cueva, E., & Moscoso, Erika Ingrid Alfaro, J. J. (2022). Evolución de la morosidad y su relación con la solvencia financiera de las cajas municipales de ahorro y crédito del Perú (2015–2020) [Universidad Peruana de Ciencias Aplicadas]. http://hdl.handle.net/10757/660398

Bernuy Barrera, M. O., & Burgos Zavaleta, V. F. J. (2022). Fragilidad financiera del sistema bancario en economías emergentes: caso mexicano. Quipukamayoc, 30(62), 57–65. https://doi.org/10.15381/quipu.v30i62.22488 DOI: https://doi.org/10.15381/quipu.v30i62.22488

Bertrand, J., & Klein, P.-O. (2021). Creditor information registries and relationship lending. International Review of Law and Economics, 65, 105966. https://doi.org/10.1016/j.irle.2020.105966 DOI: https://doi.org/10.1016/j.irle.2020.105966

Bretos, I., Díaz, M., & Marcuello, C. (2018). Cooperativas e internacionalización: Un análisis de las 300 mayores cooperativas del mundo. CIRIEC-España, Revista de Economía Pública, Social y Cooperativa, 92, 5. https://doi.org/10.7203/CIRIEC-E.92.11480 DOI: https://doi.org/10.7203/CIRIEC-E.92.11480

Chiriani-Cabello, J. E., Alegre-Brítez, M. Á., & Chung, C. (2020). Management of the credit and collection policies of the MIPYMES for their financial sustainability, Asunción, 2017. Revista Científica de La UCSA, 7(1), 23–30. https://doi.org/10.18004/ucsa/2409-8752/2020.007.01.023-030 DOI: https://doi.org/10.18004/ucsa/2409-8752/2020.007.01.023-030

Guallpa, A., & Urbina Poveda, M. (2021). Determinantes del desempeño financiero de las cooperativas de ahorro y crédito del Ecuador. Revista Economía y Política, 112–129. https://doi.org/10.25097/rep.n34.2021.07 DOI: https://doi.org/10.25097/rep.n34.2021.07

Gutiérrez Peralta, S. D., Peralta Castillo, A. L., & Mayrena Bellorín, M. U. (2021). Incidencia de la aplicación de las políticas de crédito y cobranza en la recuperación de cartera del Súper Las Segovias, S.A. de la ciudad de Estelí, Nicaragua, durante el primer semestre del año 2020. Revista Científica de FAREM-Estelí, 38, 149–165. https://doi.org/10.5377/farem.v0i38.11949 DOI: https://doi.org/10.5377/farem.v0i38.11949

Ibarra, D. (2020). La economía mundial y sus vericuetos (incluido el coronavirus). Economía UNAM, 17(50), 3–26. https://www.scielo.org.mx/scielo.php?pid=S1665-952X2020000200003&script=sci_abstract

Mogollón Gómez, J. (2021). Gestión de Cobranza y su impacto en la Gerencia Financiera de la empresa PP S.A: Periodo 2014-2016. Puriq, 3(1), 151–164. https://doi.org/10.37073/puriq.3.1.121 DOI: https://doi.org/10.37073/puriq.3.1.121

Piedra Méndez, A., Hinojosa Cruz, A., Guevarra Segarra, M., & Erazo Garzón, J. (2019). Responsabilidad social en las cooperativas de ahorro y crédito del Ecuador: una medición desde la web. Telos: Revista de Estudios Interdisciplinarios En Ciencias Sociales, 21(3), 618–642. https://doi.org/10.36390/telos213.07 DOI: https://doi.org/10.36390/telos213.07

Pimienta Prieto, J. H., & De la Orden Hoz, A. (2017). Metodología de la investigación (1st ed.). Pearson Educación.

Puente Riofrío, M. I., & Chafla Gualli, E. E. (2023). Auditoría de Gestión a los Procesos de Otorgación de Créditos en la Cooperativa de Ahorro y Crédito Credi Ya Ltda., Agencia Riobamba, Período 2020 [Universidad Nacional de Chimborazo]. http://dspace.unach.edu.ec/handle/51000/10308

Railiene, G. (2018). Comparison of Borrower Default Factors in Online Lending (pp. 231–240). https://doi.org/10.1007/978-3-319-76288-3_17 DOI: https://doi.org/10.1007/978-3-319-76288-3_17

Rakhaev, V. A. (2020). Developing Credit Risk Assessment Methods to Make loss Provisions for Potential loans. Finance: Theory and Practice, 24(6), 82–91. https://doi.org/10.26794/2587-5671-2020-24-6-82-91 DOI: https://doi.org/10.26794/2587-5671-2020-24-6-82-91

Ratten, V. (2020). Coronavirus and international business: An entrepreneurial ecosystem perspective. Thunderbird International Business Review, 62(5), 629–634. https://doi.org/10.1002/tie.22161 DOI: https://doi.org/10.1002/tie.22161

Román, M. B., Moreno, Y. de J., & Armijos, L. A. (2019). Los microcréditos y su incidencia en el crecimiento económico de las MiPymes. Un Espacio Para La Ciencia, 2(1), 227–244. https://revistas-manglareditores.com/index.php/espacio-para-la-ciencia/article/view/43

Romeo, C., & Sandler, R. (2021). The effect of debt collection laws on access to credit. Journal of Public Economics, 195, 104320. https://doi.org/10.1016/j.jpubeco.2020.104320 DOI: https://doi.org/10.1016/j.jpubeco.2020.104320

Simon, S., Sawandi, N., Kumar, S., & El-Bannany, M. (2021). Economic downturns and working capital management practices: a qualitative enquiry. Qualitative Research in Financial Markets, 13(4), 529–547. https://doi.org/10.1108/QRFM-09-2020-0181 DOI: https://doi.org/10.1108/QRFM-09-2020-0181

Testa, M., D’Amato, A., Singh, G., & Festa, G. (2024). Innovative profiles of TQM in banking management. The relationship between employee training and risk mitigation. The TQM Journal, 36(3), 940–957. https://doi.org/10.1108/TQM-01-2022-0043 DOI: https://doi.org/10.1108/TQM-01-2022-0043

Verduga-Pino, A. (2021). Consideraciones teóricas sobre la gestión de las Microfinanzas con un enfoque de Finanzas Populares y Solidarias. Revista Científica Arbitrada de Investigación En Comunicación, Marketing y Empresa REICOMUNICAR, 4(7), 42–64. https://doi.org/10.46296/rc.v4i7.0024 DOI: https://doi.org/10.46296/rc.v4i7.0024

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Jerris Rojas-Vela, Luisa Gonzáles-Alegría

This work is licensed under a Creative Commons Attribution 4.0 International License.

The authors retain their rights:

a. The authors retain their trademark and patent rights, as well as any process or procedure described in the article.

b. The authors retain the right to share, copy, distribute, execute and publicly communicate the article published in the scientific journal UNAAACIENCIA-PERÚ (for example, place it in an institutional repository or publish it in a book), with an acknowledgment of its initial publication in UNAAACIENCIA-PERU.

c. Authors retain the right to make a subsequent publication of their work, to use the article or any part of it (for example: a compilation of their works, notes for conferences, thesis, or for a book), provided that they indicate the source. of publication (authors of the work, magazine, volume, number and date).