Proposal for a tax collection system for a Peruvian municipality

DOI:

https://doi.org/10.56926/unaaaciencia.v3i2.84Keywords:

tax evasion, financial management, tax compliance, fiscal education, administrative modernizationAbstract

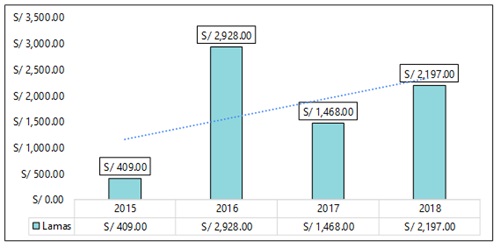

Property tax collection is one of the main sources of revenue for municipalities, essential for financing basic services and community projects. The objective of this study was to propose a tax collection system aimed at reducing evasion and improving municipal revenue during the 2015–2018 period. A non-experimental, descriptive, and propositional design with a quantitative approach was employed. The population consisted of 4,631 property owners, from which a probabilistic sample of 354 was selected. Data were collected through structured surveys and documentary analysis. The results revealed that 57% of taxpayers exhibited a medium level of tax evasion, 22% a high level, and only 21% a low level. Regarding tax compliance, 48% demonstrated a low level, 44% a medium level, and just 8% a high level. It was concluded that implementing an efficient tax collection system, supported by fiscal education strategies and administrative modernization, is essential to strengthen tax management and improve municipal revenues.

Downloads

References

Alm, J. (2021). Tax evasion, technology, and inequality. Economics of Governance, 22(4), 321–343. https://doi.org/10.1007/s10101-021-00247-w DOI: https://doi.org/10.1007/s10101-021-00247-w

Alm, J., & Malézieux, A. (2021). 40 years of tax evasion games: a meta-analysis. Experimental Economics, 24(3), 699–750. https://doi.org/10.1007/s10683-020-09679-3 DOI: https://doi.org/10.1007/s10683-020-09679-3

Alstadsæter, A., Johannesen, N., Le Guern Herry, S., & Zucman, G. (2022). Tax evasion and tax avoidance. Journal of Public Economics, 206, 104587. https://doi.org/10.1016/j.jpubeco.2021.104587 DOI: https://doi.org/10.1016/j.jpubeco.2021.104587

Aruoba, S. B. (2021). Institutions, tax evasion, and optimal policy. Journal of Monetary Economics, 118, 212–229. https://doi.org/10.1016/j.jmoneco.2020.10.003 DOI: https://doi.org/10.1016/j.jmoneco.2020.10.003

Besley, T., Jensen, A., & Persson, T. (2023). Norms, Enforcement, and Tax Evasion. Review of Economics and Statistics, 105(4), 998–1007. https://doi.org/10.1162/rest_a_01123 DOI: https://doi.org/10.1162/rest_a_01123

Cabrera Sánchez, M. A., Sánchez-Chero, M. J., Cachay Sánchez, L. del C., & Rosas-Prado, C. E. (2021). Cultura tributaria y su relación con la evasión fiscal en Perú. Revista de Ciencias Sociales, 27, 204–218. https://doi.org/10.31876/rcs.v27i.36503 DOI: https://doi.org/10.31876/rcs.v27i.36503

Cantos Figueroa, M. de L. (2014). Modelo de administración tributaria para mejorar la recaudación de los ingresos del gobierno autónomo descentralizado municipal del cantón jipijapa [Universidad Privada Antenor Orrego]. https://repositorio.upao.edu.pe/handle/20.500.12759/801

Ermasova, N., Haumann, C., & Burke, L. (2021). The Relationship between Culture and Tax Evasion across Countries: Cases of the USA and Germany. International Journal of Public Administration, 44(2), 115–131. https://doi.org/10.1080/01900692.2019.1672181 DOI: https://doi.org/10.1080/01900692.2019.1672181

Fernández-Bastidas, R. (2023). Entrepreneurship and tax evasion. Economic Modelling, 128, 106488. https://doi.org/10.1016/j.econmod.2023.106488 DOI: https://doi.org/10.1016/j.econmod.2023.106488

Kemsley, D., Kemsley, S. A., & Morgan, F. T. (2022). Tax evasion and money laundering: a complete framework. Journal of Financial Crime, 29(2), 589–602. https://doi.org/10.1108/JFC-09-2020-0175 DOI: https://doi.org/10.1108/JFC-09-2020-0175

Kurauone, O., Kong, Y., Sun, H., Famba, T., & Muzamhindo, S. (2021). Tax evasion; public and political corruption and international trade: a global perspective. Journal of Financial Economic Policy, 13(6), 698–729. https://doi.org/10.1108/JFEP-04-2020-0067 DOI: https://doi.org/10.1108/JFEP-04-2020-0067

Menezes Montenegro, T. (2021). Tax Evasion, Corporate Social Responsibility and National Governance: A Country-Level Study. Sustainability, 13(20), 11166. https://doi.org/10.3390/su132011166 DOI: https://doi.org/10.3390/su132011166

Mu, R., Fentaw, N. M., & Zhang, L. (2023). Tax evasion, psychological egoism, and revenue collection performance: Evidence from Amhara region, Ethiopia. Frontiers in Psychology, 14. https://doi.org/10.3389/fpsyg.2023.1045537 DOI: https://doi.org/10.3389/fpsyg.2023.1045537

Olguín Cruz, M. M., & Picon Aguilar, Y. D. (2022). La conciencia tributaria como herramienta para combatir la evasión en el Perú. Revista Lidera, 17, 30–36. https://revistas.pucp.edu.pe/index.php/revistalidera/article/view/26666

Romero Carazas, R., & Colmenares De Zavala, Y. M. (2021). Análisis de la evasión tributaria en el Perú. Revista Contacto, 1(2), 1–13. https://revistas.up.ac.pa/index.php/contacto/article/view/2402

Salhua Challa Salhua, D. L. C., & Mamani Chambilla, M. (2023). Factores que determinan la evasión tributaria en comerciantes de equipos informáticos de la ciudad de Juliaca, 2018 y 2021. Revista Contacto, 2(3), 26–41. https://revistas.up.ac.pa/index.php/contacto/article/view/3570

Uyar, A., Nimer, K., Kuzey, C., Shahbaz, M., & Schneider, F. (2021). Can e-government initiatives alleviate tax evasion? The moderation effect of ICT. Technological Forecasting and Social Change, 166, 120597. https://doi.org/10.1016/j.techfore.2021.120597 DOI: https://doi.org/10.1016/j.techfore.2021.120597

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Ausver Saavedra-Vela, Khunji Alarcón-Jiménez, Karen Reátegui-Villacorta, Mildred Flores-Fatama, Daysi Ventura-Garcia-de-Wong, Lourdes Guevara-Rabanal

This work is licensed under a Creative Commons Attribution 4.0 International License.

The authors retain their rights:

a. The authors retain their trademark and patent rights, as well as any process or procedure described in the article.

b. The authors retain the right to share, copy, distribute, execute and publicly communicate the article published in the scientific journal UNAAACIENCIA-PERÚ (for example, place it in an institutional repository or publish it in a book), with an acknowledgment of its initial publication in UNAAACIENCIA-PERU.

c. Authors retain the right to make a subsequent publication of their work, to use the article or any part of it (for example: a compilation of their works, notes for conferences, thesis, or for a book), provided that they indicate the source. of publication (authors of the work, magazine, volume, number and date).